In pursuit of faster growth, firms will have to choose not to do more.

Author: Ben Robinson

As Michael Porter once said, “The essence of strategy is choosing what not to do.” Strategy, as an exercise in weighing up opportunity cost and allocating resources between competing priorities, has always been about making choices and this is truer than ever.

Bruce Henderson, BCG Founder, standing in front of the ubiquitous growth/share matrix

However, traditional strategic theories have not kept up with the digital age. They present a static view of the world at a time when technology is fundamentally changing the nature of scale, the nature of work and the nature of the firm. Where sustainable competitive advantage used to come from maximizing the scale of production, it now comes via the network effects of connecting consumers with external producers. This move to networked business models raises fresh strategic questions about what not to do, both in terms of what a firm produces, but also in terms of what skills and resources it needs to employ itself. In future, the most successful companies won’t just be those with networked supply chains, but those with networked workforces.

From hierarchies to networks

There are many routes to creating a highly profitable business, but the most dependable and sustainable is to seek scale.

For the most successful industrial age companies like Ford or General Electric, this meant systematizing production to maximize output. If a firm could produce a good, say a Model T car, at greater scale than competitors, it could spread its fixed costs over larger volumes, allowing it to charge less while spending more on distribution and marketing. Achieving mass scale was a formidable barrier to entry leading to very high levels of return on capital — without necessarily having high-quality products.

In our networked world, what is inside and outside a company becomes increasingly fungible and it is clear that the bedrock of competitive advantage moves from how to scale internal organizations to how to orchestrate the most valuable ecosystem.

Today, while scale remains critical to achieving sustainable advantage, the nature of that scale is changing.

As platform companies like Uber and Amazon have demonstrated, in the age of networks and ubiquitous computing, achieving scale no longer requires firms to manufacture all of their products and services. Instead, they can source some or all of these products and services from third parties. This allows them to operate at higher scale since supply is elastic and to achieve greater quality since they offer consumers more personalized choice.

These platform models are underpinned by network effects, or demand-side economies of scale, as opposed to supply-side economies of scale. These arise not from maximizing production, but facilitating the interactions that make the platform more valuable for every participant, such as making it quicker and cheaper to get a taxi. And since network effects are not subject to diminishing, but instead increasing, returns to scale, markets move from having a few dominant players to winner-takes-most.

However, strategic theories have not kept up with this change. They continue to draw a sharp distinction between what is internal and external and ask how firms can maximize profits with existing resources or with the resources they could hire, build or buy. But, in our networked world, what is inside and outside a company becomes increasingly fungible and it is clear that the bedrock of competitive advantage moves from how to scale internal organizations to how to orchestrate the most valuable ecosystem.

This shift clearly calls for new strategic tools, but it also calls for a new approach to resourcing, one that reflects the inevitable move away from hierarchies to networks.

The changing nature of work

When competitive advantage meant maximizing output from a given set of resources, it was important to organize work into standard, repeatable tasks. These tasks were governed by strict processes and overseen by formal hierarchies. The role of senior management was to formulate strategy, the role of the rest of the organization was execute it with little autonomy to think or act for themselves.

Today, the nature of work is dramatically different, almost diametrically opposed. Ours is an information age. Networked technology has connected us and broken down the siloed and hierarchical flows of information. We have become knowledge workers whose work, where once routine and predictable, is now varied and exceptional. This requires simultaneously new ways of organizing work and also new ways of planning work.

Networked technologies have also dissolved geographical boundaries and unpicked the fixed form of work. We don’t just do different work, we can work from where we want, at the hours we choose and on the tasks we select. In other words, work has become more global, more varied and more liquid.

In its new form, it makes much less sense for work to be organised in hierarchies and we could argue whether it needs to be managed under the umbrella of companies at all. More and more people are choosing to become freelancers and, when you look at their motivation, it owes a lot to self-empowerment. They want to be free from the constraints of companies which not only set their hours, but in their pursuit of productivity, put limits on their learning and self-actualization.

The new strategic imperative

The big shifts in the nature of work and the nature of scale are taking place against a backdrop of accelerated change which has seen the longevity of S&P 500 firms shrink by a factor of 5 since the 1930s.

In response, firms have started to shorten strategic planning horizons, but what is really needed is to split strategy in two. Long term considerations like value proposition, business model and purpose seldom change and should only do so in response to major structural shifts. However, for shorter term considerations, it is important for strategy to become more closely aligned with innovation. That is to say, strategy should pivot from a function that makes well-informed yes/no decisions to one that creates the conditions for maximum agility so to impose as few of these constraints as possible. This means devolving autonomy. This means embracing a culture of experimentation. But, above all, it means embracing the power of networks.

Traditional resourcing decisions were anchored in an old paradigm. They assumed that the best people wanted to work for companies and that companies were the best place to manage them.

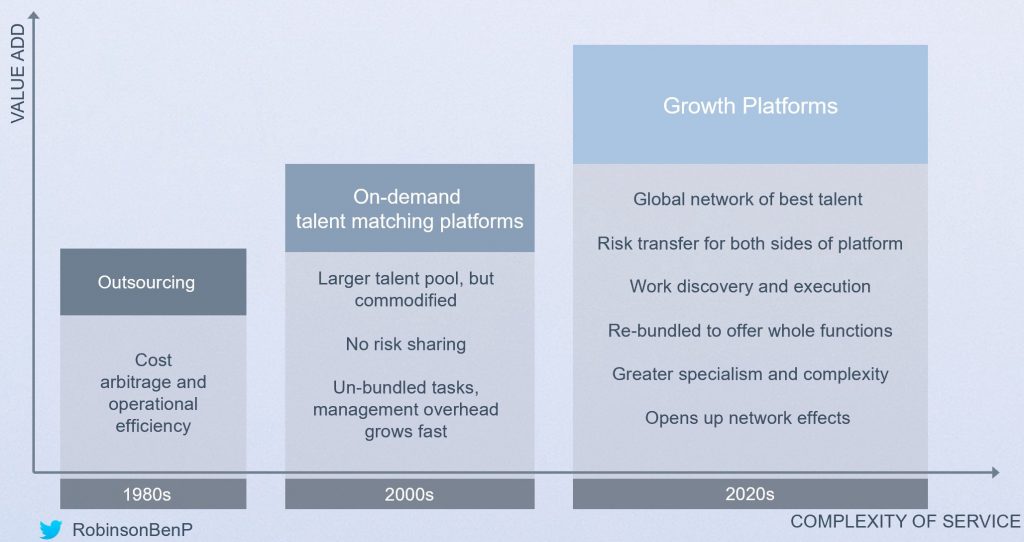

Some might argue that firms have already capitalized on the changing nature of the workforce. But outsourcing, nearshoring and offshoring were aimed at exploiting wage arbitrage — doing the same work, but with cheaper workers. There was no attempt to use the networked properties of the internet to revolutionize the way work was done.

Furthermore, the scope of any outsourcing or offshoring decisions was constrained by management theory that said companies’ internal resources must be focused on “core” areas, those with the highest strategic and operational importance. But what constitutes a core activity will change over time. When a firm is starting out, everything is core. It needs to establish its culture, its product/market fit, its business model. But, once these are established, its focus should shift to how to scale as quickly as possible and this means looking to external networks to alleviate the constraints and lower risk. It is once a firm crosses the chasm and becomes its market’s winner-takes-most that it should it think about bringing back in house some of these activities — either to deepen its moat (like Amazon having its own logistics network) or to reduce its reliance on third-parties (like Dropbox choosing to move off AWS).

And so a new approach is needed. Traditional resourcing decisions were anchored in an old paradigm. They assumed that the best people wanted to work for companies and that companies were the best place to manage them. They were conceived for a world of slower change when the opportunity cost of either being too slow to hire or hiring the wrong people was less material. They assumed all core activities had to be performed by internal resources. And they didn’t take account of the power of network effects.

In the knowledge economy, having the best people matters more than ever and establishing flows of information between independent yet interdependent individuals is critical to ensuring that they grow. As such, management place artificial and damaging impediments to fast growth when they seek to hire all of these people within their company.

The rise of the Growth Platform

Some digitally native platforms have emerged to let companies tap a broader talent pool on an on-demand basis, but these have limitations. In the case of platforms like Uber, they work against the self-empowerment of workers by subjugating them to management by algorithm, making them interchangeable commodities and internalizing all of the network effects. Platforms like Upwork are much better in that they allow for differentiation, empowering workers to be more selective about what they do as well as earn a better return on that effort. But in not sharing risk with the end client, these platforms add much less value than they otherwise could, creating an opening for a new type of business model, what we call the Growth Platform.

Growth Platforms are more capital intensive and take longer to scale than aggregation platforms, but they add much more value and are critical to the next phase of the digital economy. AWS is a growth platform, using the strength of its balance sheet to give firms access to cheap and liquid computing power and sharing network effects through the AWS Marketplace. WeWork is another example, taking the upfront risk on large real estate investment that it parcels out and makes it affordable to smaller firms, while plugging them into its network effects around community and optimized design.

However, up until now, we had not seen a growth platform for creative people and skills.

This is where Pangea comes in. Pangea mediates between companies and workers, but in a way that transfers risk from both sides. Companies don’t just get immediate access to the best go-to-market talent, but also the infrastructure to make these people perform at their best. The people don’t just get to work with fast-growing companies, but also job security with optionality as well as the ability to constantly learn.

Pangea then supercharges its value-add through network effects. The Pangea teams are external to the companies they work for, but in substance they’re very much part of it, adapting to the culture and working towards the same goals. They’re external only as condition of achieving network effects. By operating at increasing scale, Pangea accrues the network effects that enable it to better match not just requirements with people, but people with people, assembling the fluid and interdisciplinary teams to let companies adapt to greater complexity and pace of change. Furthermore, it accumulates the domain expertise, market knowledge and the ecosystem of partners that allows for continual and compounding rates of success.

Removing the constraints

Until now, firms had a binary choice: hire all of their own people or outsource. One allowed for control, the other speed. Similarly, the best people had to choose between working for one company or becoming a freelancer. One gave security, the other freedom.

Now, owing to network effects and the changing nature of work, these constraints are disappearing. By plugging into growth platforms, firms achieve control, speed and quality — at scale. And people gain freedom, security and the opportunity to keep learning.

We’re now in a new paradigm, then, where mutual success depends on firms choosing what not to do and workers choosing what to do.